Crypto whales switch from Bitcoin to Ethereum, betting $11 million

[ad_1]

One large holder, often referred to as a “whale,” recently made a bold move by purchasing 4,677 ETH tokens, worth approximately $11 million.

As reported by Lookonchain, the purchase reflects the clear bullish stance in the ETH market and the concurrent bearish sentiment towards Bitcoin.

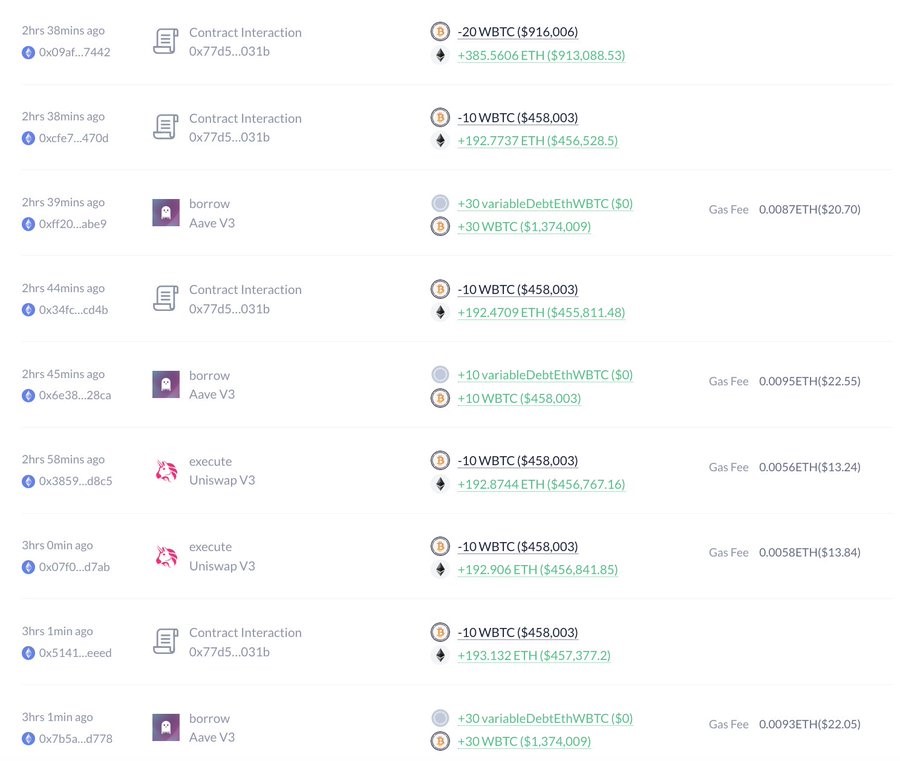

The whale made the strategic move by exchanging its holdings of Wrapped Bitcoin (WBTC) for ETH, borrowing 241 WBTC worth $11 million from lending platform Aave and then exchanging a large amount for ETH.

Whales Bullish on ETH and Bitcoin’s Outlook

The cryptocurrency community is rife with speculation about the whale’s intentions behind this move. While the exact motivation has not yet been revealed, the whale’s behavior indicates a strong belief that ETH’s price is about to rise.

This sentiment contrasts with Bitcoin’s relatively lackluster performance of late.

once Report, Bitcoin is down 4% in the past 24 hours, trading at $45,132. Prices fell amid volatile trading in the previous day. In stark contrast, ETH has shown surprising resilience, rising 5% over the same period to hit $2,380.

source: Guan Lian

ETH’s continued performance relative to Bitcoin has attracted widespread attention.

ETH’s strong performance draws interest

Market analysts, including expert Matthew Hyland, believe ETH’s outperformance is not surprising. Historical precedent shows that during key crypto events, such as the 2017 BTC futures launch and the 2021 Coinbase IPO, ETH has consistently outperformed Bitcoin immediately and subsequently.

This trend has sparked optimism among many investors about the upside potential of the top altcoins in terms of capitalization.

However, it is important to note that in the highly volatile cryptocurrency market, past performance is no guarantee of future results. Notably, legendary trader Peter Brandt maintains a bearish stance as a swing trader, contrary to the prevailing bullish sentiment among some investors.

In a recent tweet, Brandt expressed his doubts about Ethereum’s fundamental strength, saying: “My bias remains short ETH.”

Market dynamics and investor psychology

These contrasting views highlight the dynamic nature of the cryptocurrency market. In this space, investors often have different assessments and strategies. While some view ETH’s bull run as a promising opportunity, others are cautious, emphasizing the importance of rigorous analysis and prudent risk management.

While the crypto community keeps a close eye on ETH’s performance, attention has temporarily turned to Bitcoin. Growing speculation regarding the approval of a Bitcoin exchange-traded fund (ETF) may further impact market dynamics.

However, ETH’s current strength is a compelling story in the digital currency space.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Mingying

According to CryptoPolitan