2024 will be the most important year in Bitcoin history

[ad_1]

Billionaire venture capitalist Chamath Palihapitiya talked about Bitcoin in his latest interview. He believes the asset will become mainstream in 2024, driven by ETFs.

On January 7, the Canadian and Sri Lankan-American investor said that the most important trend in 2024 will be the mainstream adoption of Bitcoin.

Bitcoin will “cross the abyss”

Palihapitiya comments on the possibility of spot Bitcoin ETF approval Hypothetically, I think:

“This will be the most important year in the history of Bitcoin.”

“This is the moment when Bitcoin crosses the chasm and really gets mainstream adoption, where everyone understands what it is and can buy it easily.”

Chamath said that if all this comes to fruition, Bitcoin will become part of traditional finance by the end of 2024.

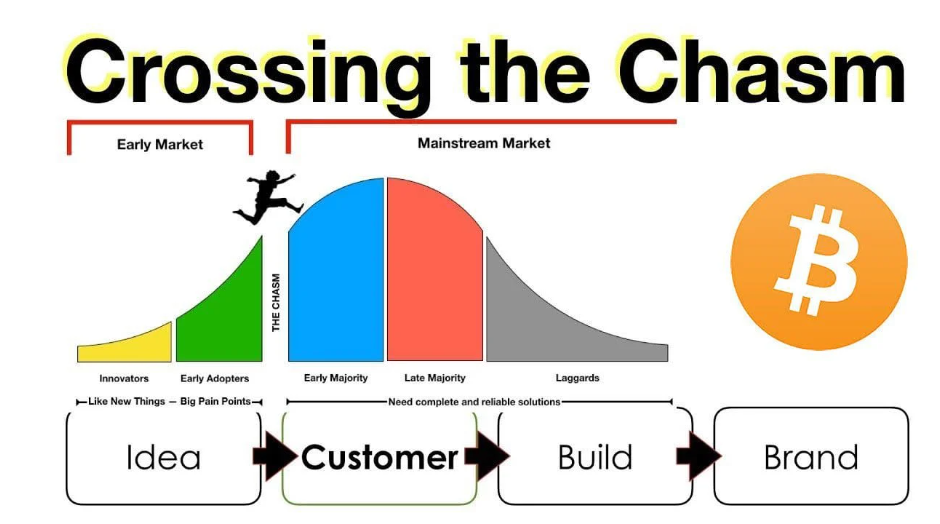

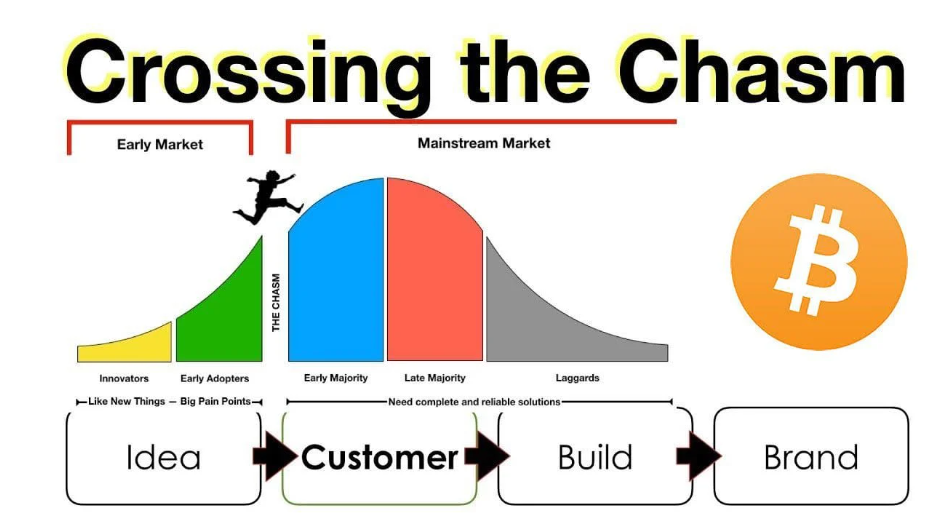

“Crossing the Chasm” refers to a concept within the technology adoption life cycle. It was popularized by Geoffrey A. Moore in his book of the same name, which described the gap between early adopters of new technologies and the majority of actual users.

Essentially, it refers to the difficulty of transitioning from an initial market of innovators and early adopters to a mainstream market. There is often a “gap” or gap between the two groups that is difficult to bridge.

Across the Abyss | Source: Luke Mikic

The “Abyss” is a huge gap with an adoption rate of just over 10%, which indicates a shift in adoption from “early adopters” to the “early adopter customer base,” explains cryptocurrency YouTuber Luke Mikic.

For a technology like Bitcoin, crossing the chasm will mean moving from visionary crypto enthusiasts to more mainstream consumer and enterprise adoption. This is often cited as a major challenge to mass adoption.

Palihapitiya’s latest remarks are in sharp contrast to his April 2023 statement that “cryptocurrency is dead in the United States.”

ETF craze heats up

Crossing the chasm is only possible if the U.S. Securities and Exchange Commission (SEC) approves one or more Bitcoin spot ETFs this week.

If this does not happen, BTC price may return to below $40,000. However, analysts and industry experts remain confident in the ETF’s passage.

On January 8, ETF Store President Nate Geraci emphasize Things to note. He said some fee information would be disclosed, particularly from BlackRock and Grayscale. In this race to increase funding and customer collateral, fee competition will be key.

He also predicted that Grayscale would convert or “upgrade” its Bitcoin Trust at the same time. It currently manages $27 billion worth of assets and has a huge advantage.

There will also be a massive promotion and media outlets across the United States will cover Bitcoin.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Stronger

According to BeInCrypto