Bitfinex releases new Bitcoin report: BTC volatility warning!

[ad_1]

Although whether a spot Bitcoin ETF will be approved from the first day of 2024 remains one of the most discussed topics among investors and the market, every piece of news affects the BTC price.

Currently, Matrixport reported last week that the SEC may reject or delay a spot Bitcoin ETF application, which has had a negative impact on Bitcoin prices.

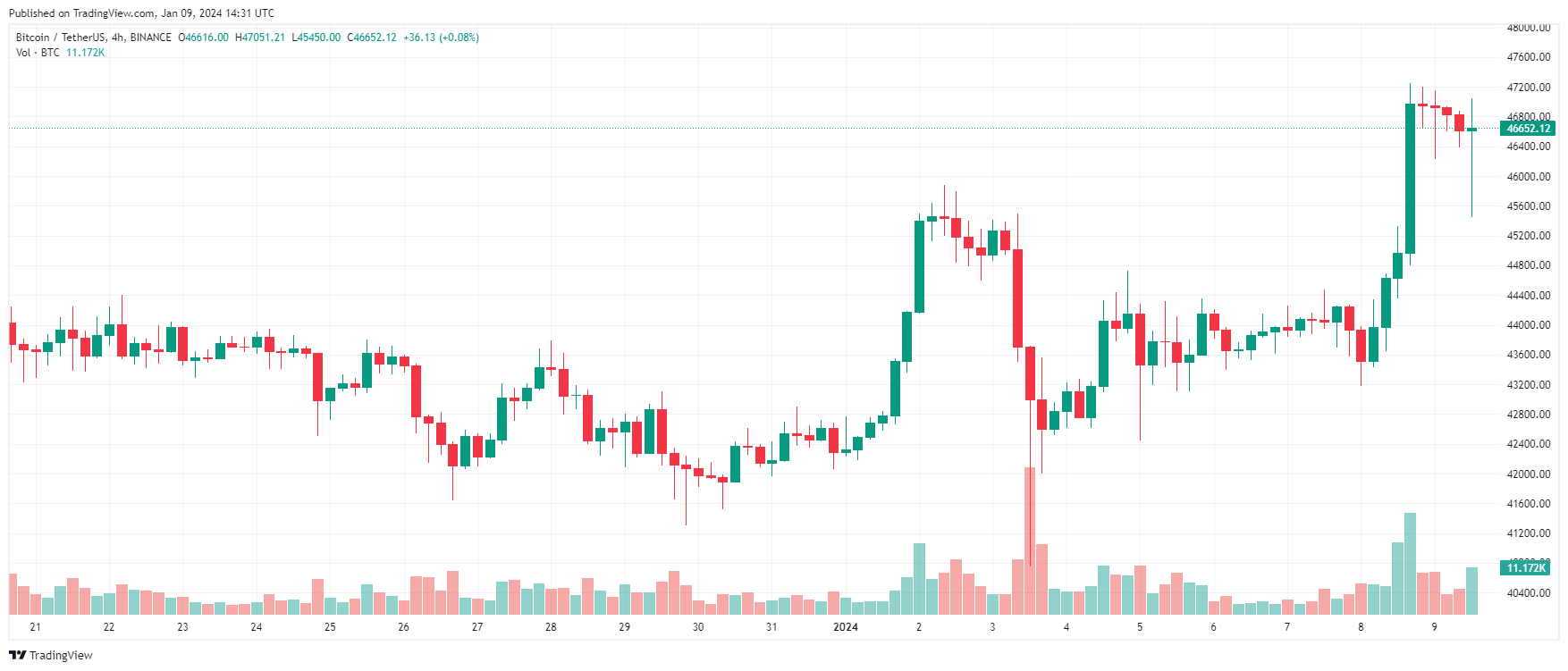

Bitcoin 4-hour price chart | Source: TradingView

After this report was released, BTC fell from $45,000 to $40,400 in a short period of time. With this decline came massive liquidation of long positions.

Bitfinex analysts believe this level of declines and liquidations is predictable and healthy.

Additionally, analysts said BTC’s decline triggered the largest wave of liquidations since August 2023, with $591 million and $94 million in long and short positions liquidated.

Analysts said the latest wave of liquidations was the third largest liquidation of long positions since the bear market hit its nadir in November 2022.

“If the new year doesn’t start bright and bustling, Bitcoin won’t have it!

On January 3, 2024, BTC fell by 11%. Reports claim that the long-awaited Bitcoin spot ETF may not be approved, leading to massive liquidations of long and short positions and the elimination of billions of dollars in open positions.

While such declines and developments are always heartbreaking, we also believe they are healthy and entirely predictable.

Currently, we know that the market is particularly vulnerable to a pullback around $44,000-45,000 and remains overly sensitive to any regulatory developments.

“Additionally, we predict that in the first few months of 2024, Bitcoin prices will fluctuate wildly along with the market, likely to see withdrawals, and be vulnerable to these withdrawals due to the increased risk of leveraged long positions.”

Ultimately, the Bitfinex analyst said that it is difficult to say whether BTC and the market will continue to fall, saying: “We believe these price drops are healthy for the market and are the result of using funds to ‘reset’ an extremely bullish price trend.” speed.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Mingying

As reported by BitcoinSistemi