Bitcoin OI exceeds $20 billion – this will be the day BTC price rises 30% and breaks ATH

[ad_1]

Bitcoin is in the midst of a historic moment, with price action hinting at an imminent breakout that could set new standards for early cryptocurrencies. Market sentiment is bullish and could be bullish as the Bitcoin ETF is about to be approved.

Taking a step back, market makers are preparing for a strong move in the market, with a Bitcoin ETF announced next week, and it only takes a few orders to push the candle above the ATH level.

Bitcoin Price Chart | Source: TradingView

Technical analysis of the Bitcoin chart shows that the asset is in balance, with local resistance levels being tested, while support levels remain unchanged. A quick look at the chart shows that the 50-day moving average is well below current price levels, acting as strong support, while the 200-day moving average is moving higher, further reinforcing the pattern of rising prices. Prices are currently hovering near a key resistance level, and a convincing breakout of this level could signal the start of a significant rebound.

Based on the number of open positions betting on BTC, the likelihood of a short squeeze occurring is very high. If the shorts begin to liquidate their positions en masse—either through traders taking profits or being forced to exit with stop-loss orders—then a significant rally could occur, pushing the price toward psychological levels of $50,000, 55,000, and $60,000. These round numbers often act as psychological barriers for traders and can act as temporary resistance points. Once you break through, however, the path to higher levels seems clear.

Furthermore, the volume curve shows that the current range has consolidated significantly, which supports the idea of a solid foundation for the upward move. The relative strength index (RSI) is in neutral territory, suggesting the asset still has room to grow before becoming technically overbought.

Bitcoin holdings soar to $20 billion, a 16-month high

Bitcoin’s open interest (OI) has increased significantly in the past 24 hours, with its notional value exceeding $20 billion, its highest level since December 2021, according to data from Coinglass. The growth appears to have reignited the market energy that Bitcoin displayed when it hit all-time highs in November 2021.

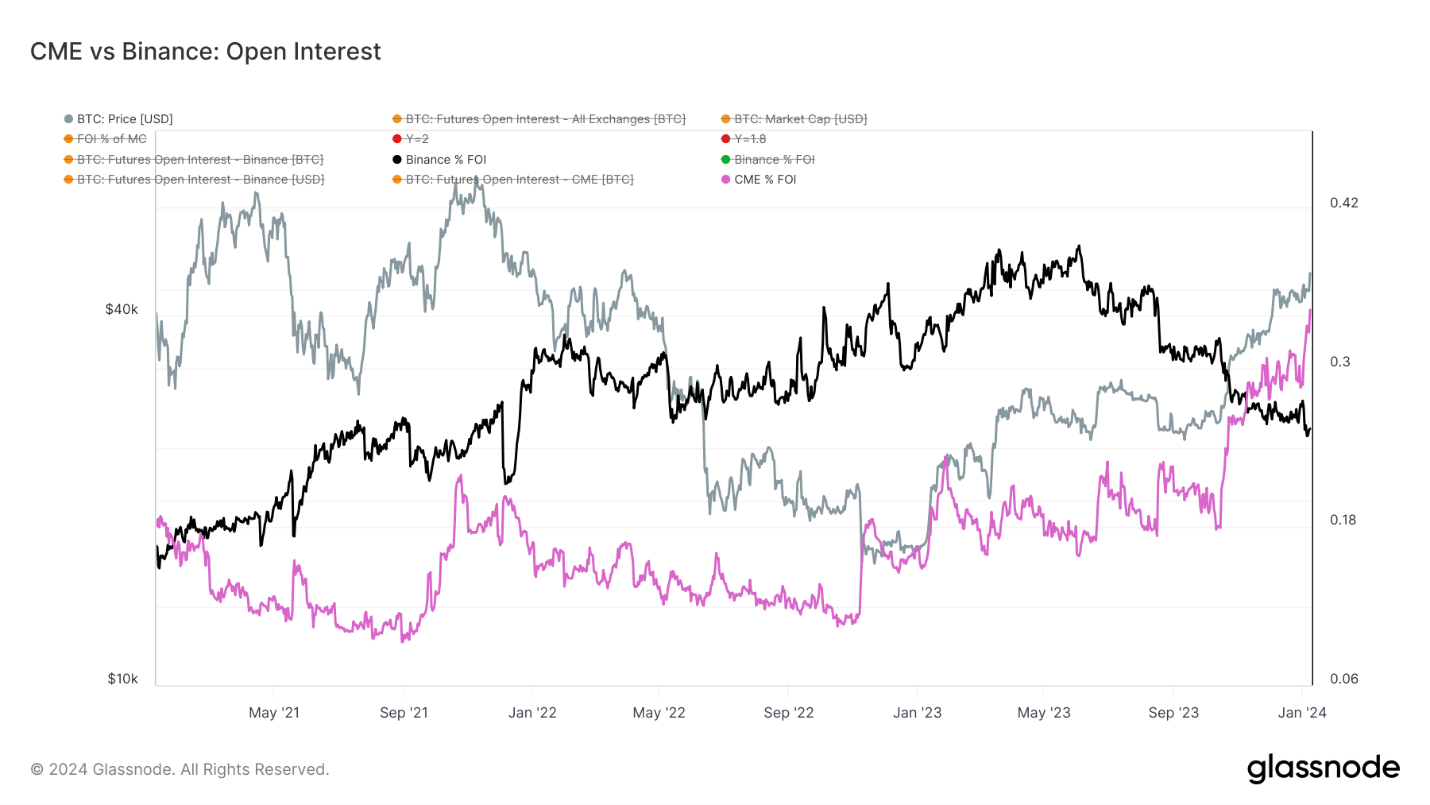

Over the past 24 hours, OI has significantly increased by 10%. Notably, CME has grown significantly by 15%, with 133,000 BTC currently allocated in open interest, with a notional value of $6.2 billion. Binance has mirrored this trend, rising 10% in the past 24 hours to a nominal value of $4.55 billion, equivalent to 98,000 Bitcoins. These numbers make up the 437,000 BTC currently allocated in open interest.

Amid these dynamics, CME continues to dominate, reaching an all-time high of 30%. These developments reflect growing market participation and suggest significant changes may be coming to the Bitcoin landscape.

CME OI and Binance | Source: Glassnode

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to AZCoin News