Analysts Say 80% of Major Jurisdictions Will Tighten Cryptocurrency Regulations by 2023

[ad_1]

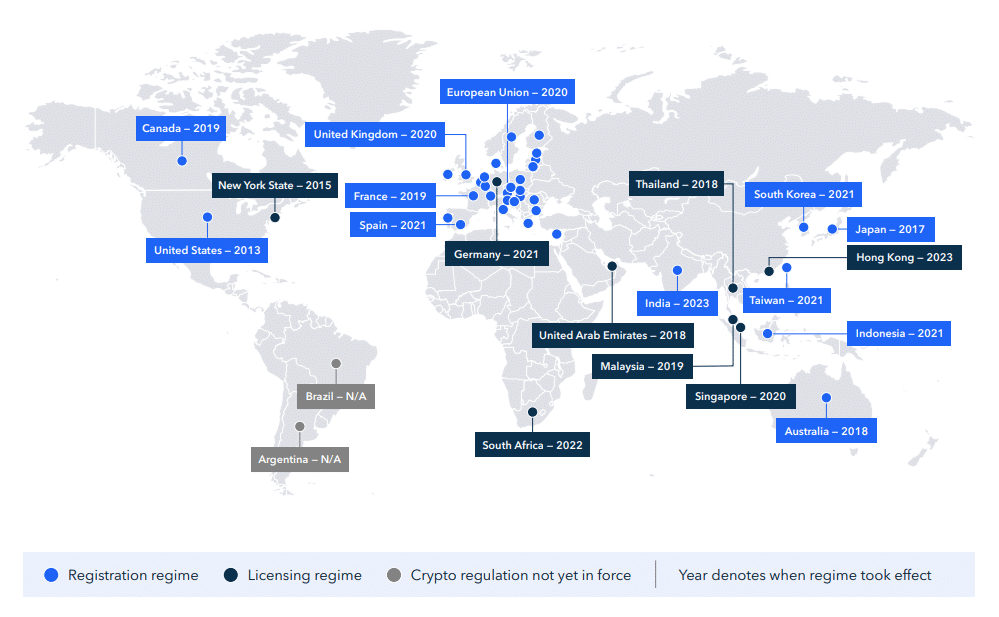

According to data compiled by TRM Labs, approximately 80% of 21 major jurisdictions (accounting for approximately 70% of global cryptocurrency exposure) have strengthened cryptocurrency regulations in 2023.

in a research report Blockchain analysis company TRM Labs announced on January 8 that nearly 80% of jurisdictions around the world have taken measures to strengthen supervision in the cryptocurrency field. Almost half of these jurisdictions have specifically proposed initiatives to strengthen consumer protection.

While each jurisdiction prioritizes national goals differently, analysts at TRM Labs found that cryptocurrency exchanges operating in countries with mature licensing and regulatory frameworks exhibit “lower rates of illegal activity than jurisdictions with less regulatory oversight.” Rates of illegal activity in jurisdictions.”

Although the United States lacks a comprehensive regulatory framework for cryptocurrencies, TRM Labs expects a key federal court ruling in 2024 on whether specific crypto assets can be considered securities.

“We can also expect enforcement momentum to continue, particularly against mixers and other anonymity-enhancing tools.”

TRM laboratory

Analysts acknowledge that there are uncertainties in the decentralized finance space, particularly around issues of responsibility, accountability and the actual exercise of oversight and power by regulators. While clear answers to these questions may not emerge in 2024, TRM Labs said the year is expected to be a time of “implementation and benchmark setting of the next (hopefully less crazy) chapter of digital assets.”

U.S. regulators’ current stance on cryptocurrencies remains uncertain, as they have previously signaled that existing financial laws still apply to digital assets. In December 2023, the U.S. Securities and Exchange Commission (SEC) explained its denial Coinbase’s rulemaking petitioncited three reasons: existing law already applies to crypto securities markets, the SEC addressing crypto securities markets through rulemaking, and the need to retain the Commission’s discretion in determining rulemaking priorities.

Still, Coinbase chief legal officer Paul Grewal said the company will try to get another appeal to get the SEC to give up its responsibility for determining cryptocurrency regulatory standards.