UNI supply on CEX exceeds $420 million – token price could drop significantly

[ad_1]

Although the open source project Uniswap (UNI) announced on January 3 that it successfully facilitated $1.7 billion worth of swap transactions, the year has not started well. Despite this statistic, UNI price fell by approximately 20% in 1 week, and volume and active addresses have also declined since the beginning of the year.

On-chain indicators show UNI price falling. As exchange supply increases, addresses and activity also decrease, which may increase selling pressure on this DeFi token. Anticipation of spot Bitcoin ETF approval failed to spur a resurgence in DeFi assets, much unlike other altcoins in the ecosystem.

Calibrating data signals on the chain Uniswap

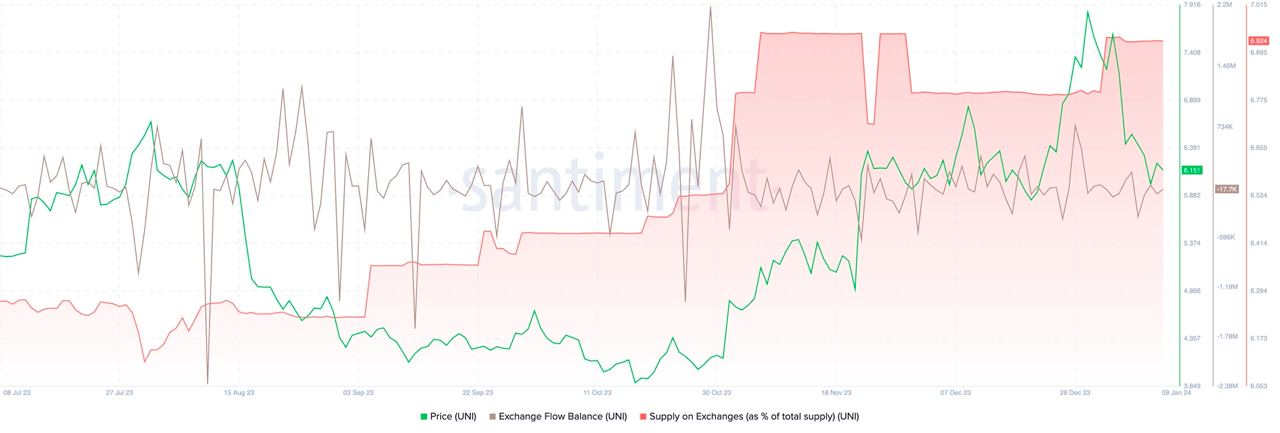

On Tuesday, Uniswap supply on the exchange increased to 6.92% of total supply, near a six-month high. The flow of UNI tokens to exchanges was relatively high in January, with the value of Uniswap tokens exceeding 420 million. There is $10 billion in circulation on the exchange platform.

With steady inflows of funds, this DeFi asset may face increasing selling pressure. Typically, increased selling pressure causes asset prices to fall. This may explain the 20% drop in UNI prices over the past week.

Exchanges and prices for UNI supply | Source: Santiment

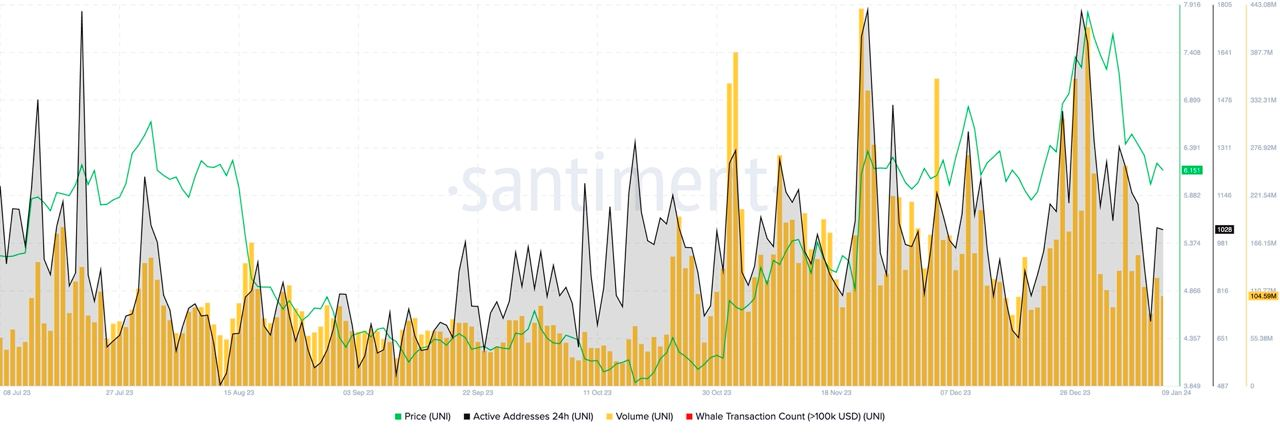

Two other on-chain metrics are active addresses and the number showing price drops. According to data from Santiment, Uniswap has been trending downward since early January.

These indicators demonstrate the correlation of assets and reflect the needs of market participants. When combined with increasing exchange supply, it signals pessimism for UNI price.

UNI address and quantity| Source: Santiment

Despite completing a $1.7 billion swap on January 3, Uniswap price has failed to recover. UNI holders are losing nearly 20% weekly and nearly 8.7% monthly. At the time of writing, UNI price is $6.01, down 0.63% on the day.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Mingying

According to FXStreet