Coinbase says the current cycle of Bitcoin and Ethereum is similar to 2018-2022

[ad_1]

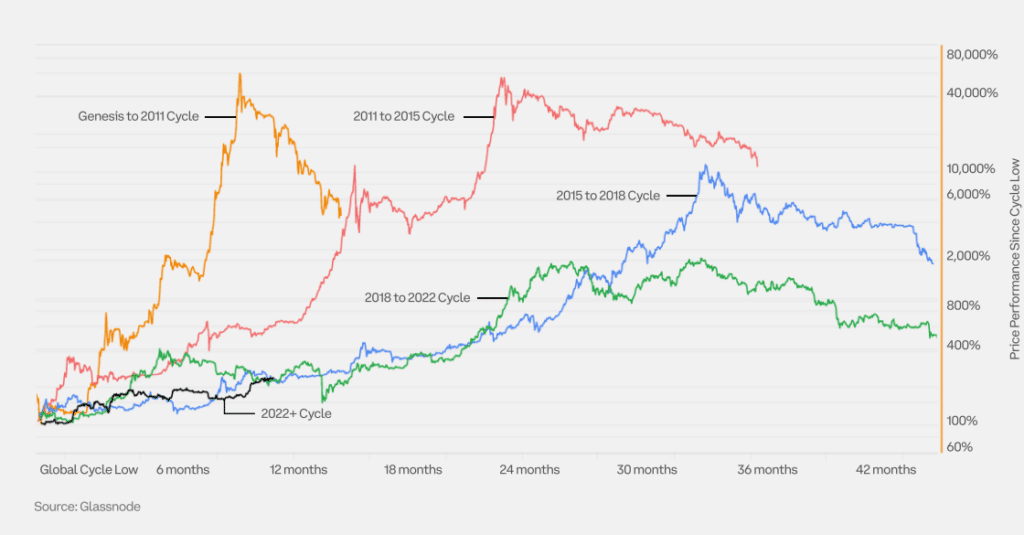

Coinbase research said that Bitcoin and Ethereum appear to be following the pattern of previous years, when their prices increased by 500% and 1,000% respectively.

According to new reports, the current cryptocurrency market cycle for Bitcoin (BTC) and Ethereum (ETH) closely correlates with the period from 2018 to 2022, when both cryptocurrencies saw significant price increases. research report Conducted by Coinbase Research and Glassnode.

As analysts noted, various cyclical indicators, including net unrealized gains and losses and profit supply, follow previous trends and suggest that the current state of the cryptocurrency market does not reflect the optimistic conditions seen in the longest period of 2023, This shows that the market still has room to rise.

While acknowledging that the upcoming Bitcoin halving could have a positive impact, Coinbase Research remains cautious, noting that supporting evidence is limited and describing the relationship as somewhat speculative.

“Having only occurred three times in history, we have yet to see a clear pattern fully emerge, especially given that previous halving events were affected by factors such as global liquidity measures.”

Coinbase Research

Based on current mining rates, the next Bitcoin halving is expected to occur in April 2024. The block reward will be reduced from 6.25 BTC to 3.125 BTC.

Regarding Ethereum, analysts are focusing on an upcoming upgrade called Cancun. Designed to enhance scalability and security, this upgrade aims to make Layer 2 transactions as cost-effective as possible, potentially leading to a significant increase in the number of transactions processed on the Ethereum network.

Coinbase also noted that both Bitcoin and Ethereum have gone through two cycles, including bull and bear markets, with the ongoing cycle starting in 2022 closely related to patterns observed in previous cycles.