Selling pressure intensified after the breakthrough, with the Vietnam Index falling to 1,155 points

[ad_1]

Selling pressure intensified after the breakthrough, with the Vietnam Index falling to 1,155 points

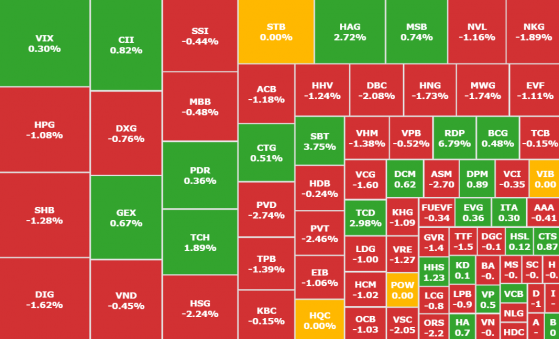

Selling pressure intensified after the breakthrough, with the Vietnam Index falling to 1,155 pointsThe boosting effect of banking stocks and real estate stocks weakened, and the stock market fluctuated within a narrow range at 1,160 points. 2pm: When more than 10 symbols such as GAS (HM:), HPG (HM:), VRE (HM:), BCM (HM:), PLX (HM:), GVR, etc.) decline by more than 1%, the group selling pressure increases ( HM::), ACB (HM:)… extended losses to 4.3 points to 1,155 points.

11:30 am: The Vietnam Index entered the lunch break, falling nearly 3 points to 1,157.45 points; the HNX-index fell slightly by 0.6 points to 232.7 points.

At the end of the morning session, market width was more in favor of the sellers, with 250 advancing symbols and nearly 380 declining symbols.

While banking groups did not play a supporting role, VCB (HM:) remained very active in supporting the market.

Many large-cap stocks put considerable pressure on the market. VHM (HM:), GAS, MWG (HM:), HPG, VIC (HM:) are the top 10 symbols pulling down the index.

Industry groups favor a decline. Mining groups remained the strongest decliners. In contrast, electrical equipment and rubber remained optimistic.

The total transaction volume in the morning market reached nearly 10 trillion VND, which is a quite positive figure. However, foreign investors remained net sellers, selling nearly VND175 billion in early trade.

11:10 am: Red throughout all 3 levels. Selling pressure in the VN30 stock group (21 discount codes) caused the VN30 index to fall by more than 5 points. The Vietnam Index currently adjusts 2.3 points to below 1,160 points.

10 O’Clock: On January 9, the stock market fluctuated in early trading. Against the backdrop of profit-taking in key stocks, a tug-of-war broke out between the two cities.

Vietnam’s index rose close to the reference point of 1,160 points. Red is dominant on the HoSE and VN30 baskets. Bank stocks were clearly divided, with only BID (HM:), ACB, STB (HM:) and SSB rising slightly. Among them, VCB stocks continue to be the driving factor, rising six times in a row since the beginning of the year, and active buying takes an overwhelming advantage.

There are many bright spots in the real estate stock group, among which CII (HM:) and PDR (HM:) both rose by more than 2%, HQC, ITA (HM:), NBB (HM:), NVL (HM:), etc. .also showed positive growth.

Stocks in the group traded poorly except for the VIX (HM:) which rose 1.5% and saw 9.2 million shares change hands.

HTP and PSH companies still maintain the buyer’s white floor price. P Oil and Gas Group (PVS (HN:), PVB, PVC (HN:), PVD (HM:), PLX) all fell within 1%.

>> HAGL (HM:) – 10 years of ‘selling out’ to pay off debt: Is BAPI the last deal?