Data shows Monero, Zcash market liquidity hits record lows

[ad_1]

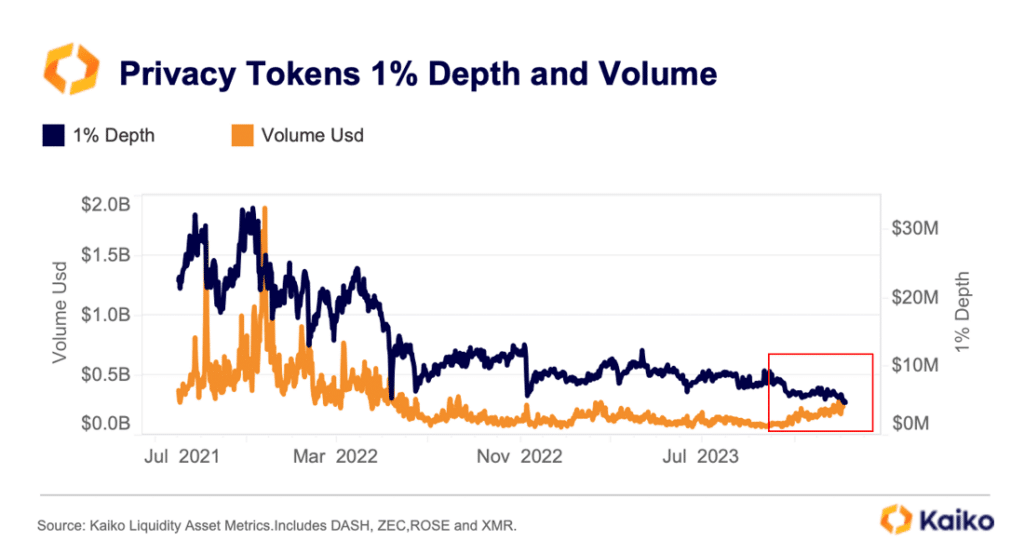

Data from Kaiko shows privacy tokens face challenges meeting cryptocurrency exchange listing standards amid regulatory pressure, leading to record low liquidity.

in the most recent research reportAnalysts at Kaiko revealed that market liquidity for privacy coins including Monero (XMR), Zcash (ZEC) and DASH has reached an all-time low as cryptocurrency exchanges continue to remove these assets from their lists. Data shows that the privacy-focused token had just $5 million in liquidity last week after OKX removed multiple trading pairs related to the assets.

“While trade volumes have gradually increased since October, they are still well below 2021 levels.”

Beizi

Kaiko analysts pointed out that due to regulatory pressure in the past few years, privacy tokens have been increasingly delisted by major platforms.

This exacerbated the decline in liquidity during the cryptocurrency bear market. Kaiko noted that XMR and ZEC are currently at high risk of being delisted on Binance due to low liquidity, adding that ZEC is “the most delisted privacy token in the past two years.” Analysts say this has led to a more fragmented market, with XMR dominating large exchanges while ZEC and DASH are primarily traded on smaller, unregulated venues.

In early January, crypto.news reported that Binance expanded surveillance label coverage with 10 additional coins, including Monero (XMR) and Zcash (ZEC). Binance has stepped up its efforts to strengthen risk management after admitting to a series of crimes in late 2023, including money laundering and failure to comply with know-your-customer (KYC) regulations imposed by the U.S. Securities and Exchange Commission (SEC). ).

Despite the prevalence of delistings, not everyone in the cryptocurrency industry shares the same view. In September 2023, Ethereum co-founder Vitalik Buterin stated that centralized entities like custodial exchanges were “fragile” and could be breached, stressing that users should be able to transact directly on the Ethereum blockchain , without relying on a centralized provider.