CryptoQuant reveals two potential scenarios for spot Bitcoin ETFs

[ad_1]

Analysts at CryptoQuant have revealed two scenarios that could occur before a spot Bitcoin (BTC) ETF is approved.

CryptoQuant experts analyzed the first cryptocurrency’s support and resistance levels based on the average price among BTC holders and presented two scenarios: bullish and bearish.

According to the first bullish scenario, the price of BTC could reach a local peak of $48,500 before the U.S. Securities and Exchange Commission (SEC) makes a final decision. In this case, the proportion of short-term holders (one day to one week) would exceed 8%, indicating an overheated market. Furthermore, this indicator increases the possibility of correction. This level could become a major resistance for Bitcoin. $48,500 is the average price among long-term holders.

In a bearish scenario, the price of BTC could fall by 2-30%. Historical data bears this out: after periods of active growth, values typically decline. If this happens again, the key support levels will be $30,000 and $34,000. The first indicator is the average price among long-term holders, and the second indicator is the average price among short-term holders.

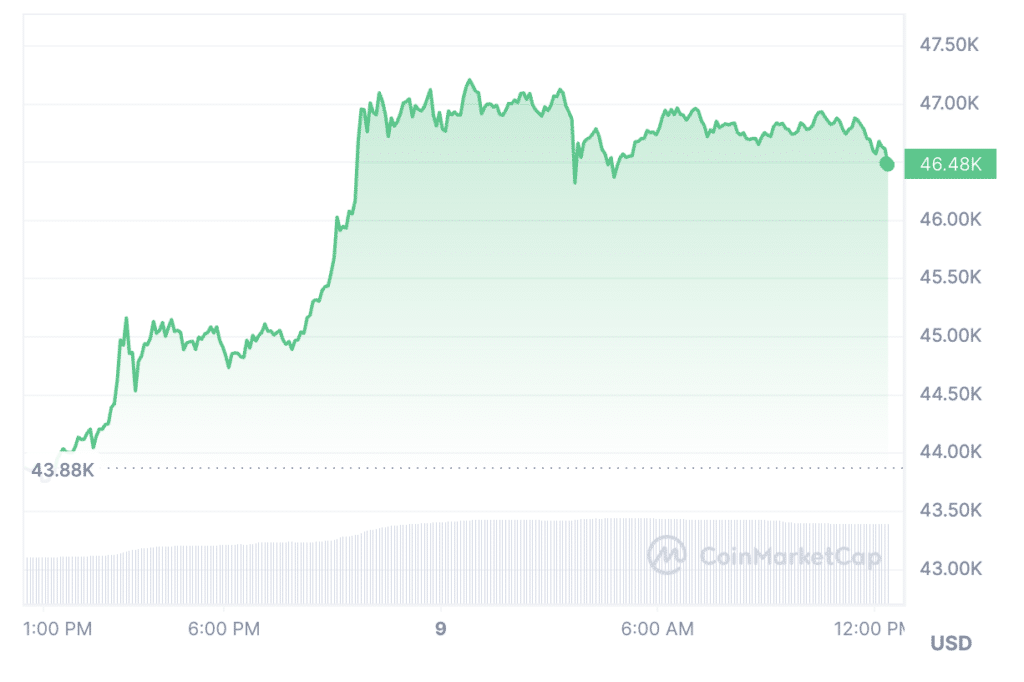

On January 8, BTC price once again hit a yearly high of $47,218. This level was last reached in April 2022. As of this writing, Bitcoin is currently trading at $46,477, according to CoinMarketCap. The asset’s value has increased by 7% in the past 24 hours.

The fate of spot Bitcoin ETFs remains uncertain. The cryptocurrency market is awaiting the SEC’s decision on the filing this week.