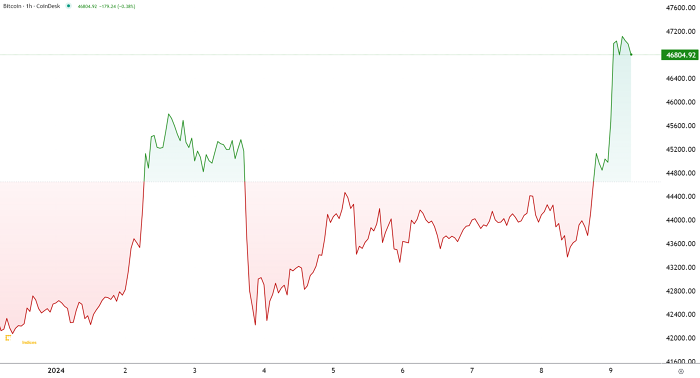

Bitcoin breaks through $47,000, hitting 21-month high

[ad_1]

©Reuters

©Reuters According to Khac Hieu

Investing.com – Bitcoin price surpassed the $47,000 mark on the morning of January 9 (Vietnam time) as investors awaited approval from the U.S. Securities and Exchange Commission (SEC) for a Bitcoin ETF for immediate delivery. Bitcoin last traded at $47,000 in April 2022.

At around 4:30 a.m. on January 9, Bitcoin reached 47,257, its highest level in 21 months. As of around 7 a.m. that day, the price of the currency had fallen to approximately $47,073, an increase of 7.2% from 24 hours ago.

Apart from Bitcoin, other currencies have also seen positive results. Ethereum is up 5.46% in the past 24 hours to $2,337. Binance Coin (BIN) rose 1.21%, (SOL) rose 10.46%, and (XRP) rose 4.87%.

Bitcoin rebounded quickly against the background of the final update of financial giants such as BlackRock and Grayscale submitting applications for open spot ETFs to the SEC. The update included important information on costs, helping to boost investor sentiment.

“This is a price war,” said Jim Angel, an associate professor of financial market structure at Georgetown University’s McDonough School of Business. There are many (spot ETF) providers launching almost identical products, and the only way to compete is on price. “

On January 10, the SEC will have to deny or approve Ark Invest’s ETF application. Markets expect the agency to approve a batch of applications simultaneously to create balance.

“Acceptance is inevitable. Nothing needs to be decided… This is a huge step forward not only for Bitcoin but for financial markets as a whole,” former SEC Chairman Jay Clayton told CNBC.

The above decision will be a turning point for the cryptocurrency industry. Although Bitcoin or Ethereum were born as alternatives to traditional financial means, they have now found a place in the investment world.

The move in Bitcoin prices also coincided with a drop in bond yields and a recovery in U.S. stocks during the January 8 (local time) trading session.

In addition to Bitcoin, financial companies are also applying to open spot Ethereum ETFs. The SEC will approve the application before the end of this year.

Meanwhile, shares in the cryptocurrency business also surged during the trading session earlier this week. CoinBase shares rose another 3.5%, while mining companies such as Riot Platforms (NASDAQ:) and Marathon Digital (NASDAQ:) each rose more than 7%.

Many investors believe the impact of the ETF’s passage has been overestimated. However, this incident may attract more institutional investors’ funds into the cryptocurrency market.

Galaxy Digital estimates that the total addressable market (TAM) for Bitcoin ETFs is $14 trillion in the first three years, expanding to $26 trillion next year and $39 trillion in the third year.

Don’t know how to analyze and evaluate a business based on profit and revenue information? Don’t worry, we have pricing and analysis tools for you. InvestingPro helps you understand the correct prices for buying and selling stocks. InvestingPro is easy to use, provides non-professional investors with all the information available, and the cost is attractive (this year only).Learn about this tool here and get up to 60% off + 10% extra discount when you enter the code Tang Bopu Enter this and InvestingPro+ when entering code dibutyl phthalate Enter this