Cryptocurrency investment surges in 2024: $151M inflows show strong start

[ad_1]

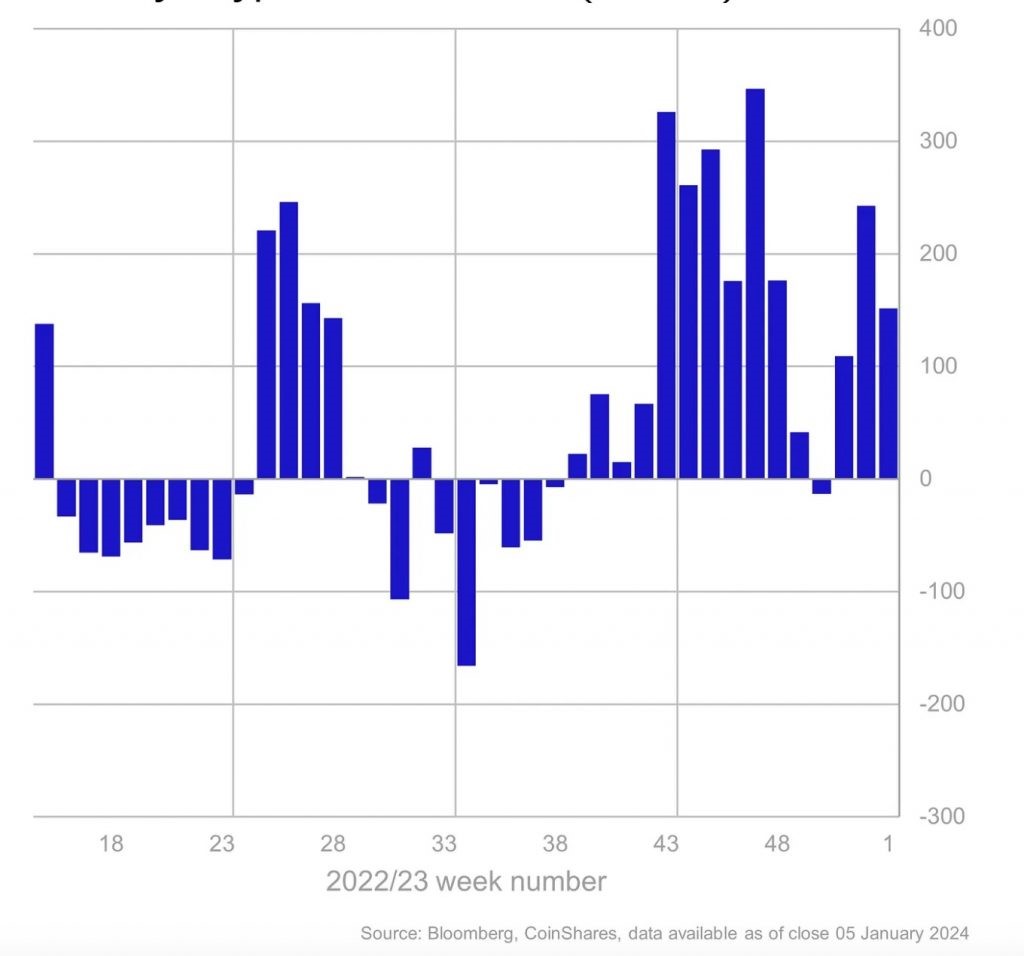

The first week of 2024 marks a strong start for cryptocurrency investing, as revealed in CoinShares’ latest weekly digital asset flows report. Report Detailed the massive inflow of $151 million into digital asset investment products, bringing the cumulative inflow to $2.3 billion since the Grayscale v. Securities and Exchange Commission (SEC) case. This investment surge represented 4.4% of total assets under management (AuM).

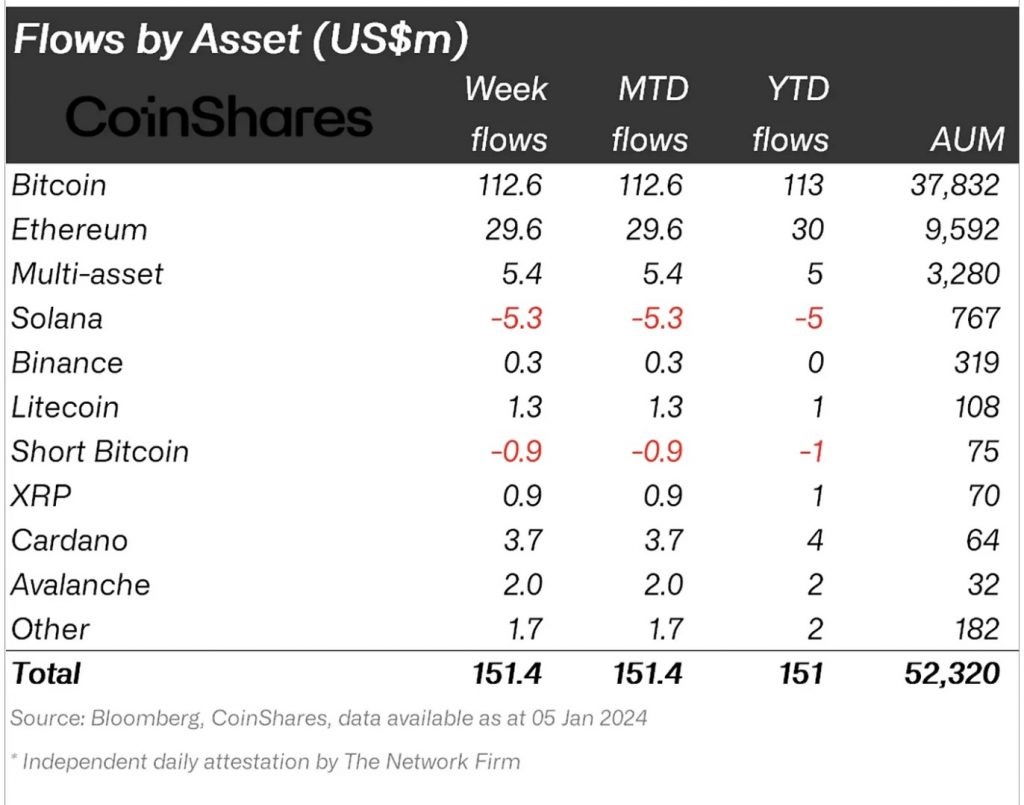

Bitcoin leads the way, attracting the majority of inflows over the past nine weeks, amounting to $113 million or 3.2% of assets under management. Interestingly, short Bitcoin products saw outflows of up to $1 million in the first week of the year, contrary to expectations surrounding the ETF’s launch in the United States. It is worth noting that the predicted “buy the rumor, sell the fact” trend has not materialized, with outflows from short Bitcoin ETPs totaling $7 million in the past nine weeks.

Source: CoinShares

ETH saw a positive change in sentiment, attracting $29 million in inflows. This marks a major change and signals renewed interest in cryptocurrencies. Meanwhile, Solana has had a rough start to the year, with outflows totaling $5.3 million.

Other altcoins also saw significant inflows, with Cardano, Avalanche, and Litecoin attracting $3.7 million, $2 million, and $1.4 million respectively.

Source: CoinShares

In terms of geographical distribution, although there are no spot ETFs in the United States, 55% of capital inflows come from exchanges in that country. Germany and Switzerland also made significant contributions, accounting for 21% and 17% of total inflows respectively.

Beyond cryptocurrencies, blockchain stocks have also had a positive start to the year, with inflows totaling $24 million in the past week. Beyond digital currencies, broader interest in the blockchain ecosystem demonstrates growing investor confidence in related technologies and industries.

The report’s findings highlight the enduring appeal of digital assets despite regulatory uncertainty and recent market volatility. Investors appear to be responding to this changing landscape by diversifying into various cryptocurrencies and blockchain-related assets, indicating that the market is maturing and is ready for growth, continued growth, and innovation.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

according to AZCoin News