Solana Drops to $90, Indicators Show Rebound Potential

[ad_1]

Solana (SOL) price has fallen sharply over the past week after continuing to rise in December.

SOL has fallen 4.5% in the past 24 hours and is trading at $90.7 at the time of writing. The asset’s market capitalization fell to $39.2 billion, creating a $6 billion gap with BNB, the fourth-largest cryptocurrency.

However, Solana’s daily trading volume soared 39% to $2.9 billion.

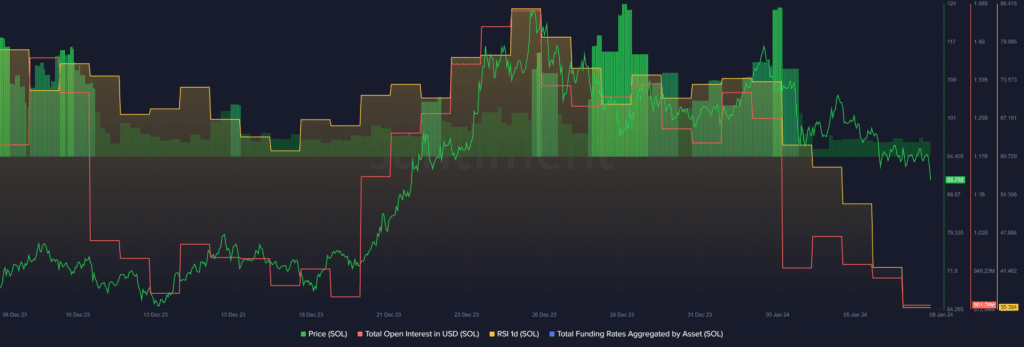

According to data provided by Santiment, the Solana Relative Strength Index (RSI) is currently hovering around the 35 mark. According to the data provider, the asset’s RSI has been declining over the past week – SOL’s RSI on January 2 was 73.

The indicator suggests Solana could be facing significant upside as selling pressure is less than it was last week when the asset was trading around $110.

Solana’s RSI needs to remain below the 50 mark for price growth to occur.

Additionally, SOL’s total open interest (OI) fell from $1.3 billion on January 1 to approximately $880 million at the time of reporting, according to Santiment data.

The total funding rate aggregated by Solana is currently 0.008%, down 90% in the past seven days. This suggests that long position holders have a slight advantage over short position holders ahead of further moves.

The drop in OI suggests that as Solana falls below the $100 mark, investors are either facing strong liquidation or closing their positions.